The Virtual Insurance Agent

Introduction

Companies worldwide will spend more than $400 billion on call centers in 2022,and insurance companies will be among the big spenders - all to deliver an experience to customers that no one would consider optimal.

Customers are frustrated at all the forms they need to fill out as they deal with insurers and all the paper they need to shuttle around. They bristle when they deal with one part of the company and then find they have to start over when dealing with another, or when they get one sort of communication from, say, an agent that feels and sounds very different from what they hear and receive from a rep in a call center. 72% of consumers say that when contacting customer service they expect the agent to know who they are and what they've purchased and to have insight into prior engagements - but often find the experience lacking.

And customers will only become more demanding. Ever since Amazon and other Big Tech companies have shown consumers how simple a digital interaction can be, customers have been "Amazoning" companies they deal with in every industry- demanding that same sort of "one-click," easy experience. The pandemic has greatly accelerated the move to digital interactions and made customers even more likely to insist on fast, anytime, digital, self-service options.

Customers aren't forgiving, either: 40% to 50% say they've stopped doing business with a company because of a single bad experience, according to a Statistica survey.

Fortunately, a form of artificial intelligence known as conversational AI is allowing companies to greatly improve the customer experience while slashing costs.

Conversational AI lets customers use normal English to interact with a virtual agent and allows companies to resolve as much as 80% of contacts without the need for human intervention, while shortening by up to 40% the calls that do require a customer rep. The virtual agent serves as the point of integration, reaching across silos and into back-end systems to pull together all relevant interactions and other customer data, while making sure the customer receives the right information in a consistent tone. A human expert can always be available to be brought into the conversation at a moment's notice.

The technology not only helps provide customers with the self-service options they appreciate - and increasingly demand - but also can automate and simplify insurers' interactions with agents.

Conversational AI has been around for more than two decades, mostly used inself-service parts of websites. But it has become much more robust, especially as AI has become so good at what's called natural language processing - the ability to understand queries and statements in normal English (or dozens of other languages) and to then respond in a growing number of situations as a person would. As a result, conversational AI solutions can now not only pull together all relevant information about a customer and process an interaction but can recognize customers and interact with them in the way they want to be treated -efficiently and accurately.

The virtual agent will continue to improve rapidly, too. Machine learning can be used to track interactions to continually look for areas for improvement. And the underlying computing technology for AI is adding power even faster than the exponential rate that we've come to expect from computers.

The sky is the limit for conversational AI.

Everyone knows what bad customer service feels like. You have a simple question but have to go through a phone tree, hitting "1 for English," then "3" for something else in the next branch of the tree, then "2" for still another thing, only to find that your query doesn't exactly match anything in the menu.

So, you hit "0" for a customer service rep - and get put on hold for two minutes while getting ad pitches for things you don't want or listening to music you don't like. You have to figure out your account number and dig up information that the insurer mailed you months ago, and may still have to wait for forms to be emailed or even sent via the Postal Service. Somewhere along the way, you get transferred to another department, where you have to start all over and where you may get information that conflicts with what the first rep told you.

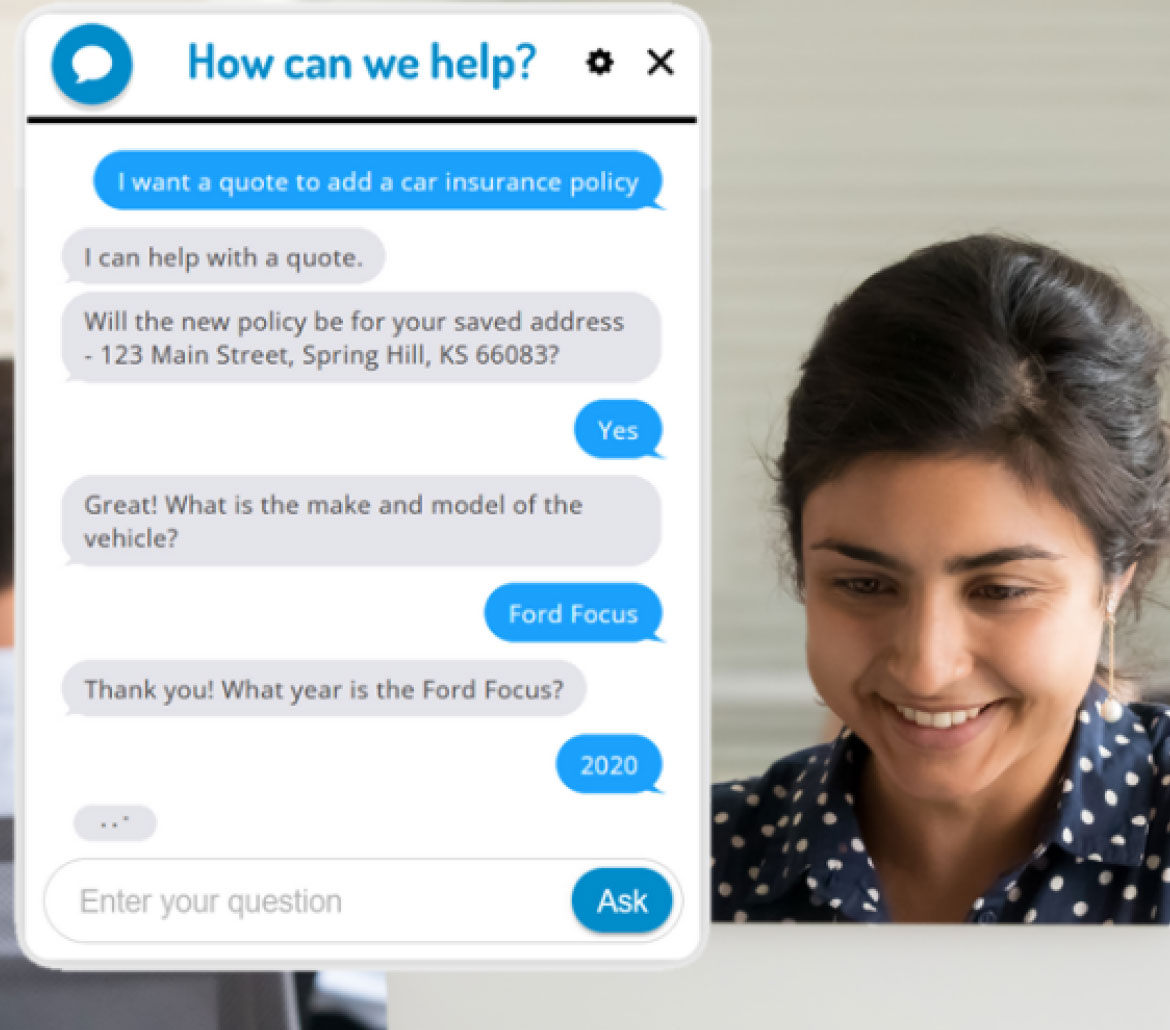

Wouldn't it be nice to have a customer experience like the one in the graphic? You text your insurer a question, and you get an instant answer. No muss. no fuss.

Yes, many interactions will be too complicated for a virtual agent to completely handle, but conversational AI can respond to a high percentage of contacts from customers and agents and, in the process, create a better customer experience; improve the agent experience and boost productivity; reduce contact center traffic; increase revenue; lower support costs; and improve efficiency.

Everyone knows what bad customer service feels like. You have a simple question but have to go through a phone tree, hitting "1 for English," then "3"for something else in the next branch of the tree, then "2" for still another thing, only to find that your query doesn't exactly match anything in the menu.

Create better customer experience

Conversational AI boosts customer satisfaction and loyalty because it provides24/7 digital support that is personalized, convenient and easy to use. An Accenture study found that 61% of consumers prefer using digital channels to check on the status of claims and that 44% would leave an insurer if it didn't have digital capabilities. So, digital interactions with customers and agents have become table stakes - and conversational AI is the state of the art.

Improve agent experience and productivity

Tom Wilson, CEO of Allstate, has said he doesn't want agents to have to be" human modems," spending huge amounts of time filling out forms and just passing information back and forth between carriers and clients. Conversational AI lets customers go straight to carriers for most routine queries on issues such as the due date of payments and the status of claims, freeing agents to do other, more valuable things. The technology simplifies many agents' queries to carriers, too.

Reduce contact center traffic

Any call that a virtual agent can answer is one less call for the contact center to handle. Conversational AI tools also remove much of the drudgery for agents, who can focus on queries that require their expertise. Morale in the call center goes up because reps are solving real problems for people, not just looking up a routine record. And when morale goes up, employee turnover drops.

Increase revenue

The better experience reduces customer churn. The virtual agent also reduces the number of people who drop out during the buying process, because that process happens much faster and more easily. The virtual agent, which is always learning, also can spot opportunities to up sell and cross-sell and alert agents about how to approach a client.

Lower support costs

When virtual agents take so much load off the call center, it reduces the costs of customer support. The lower employee turnover also reduces the costs of training new reps and then giving them time to move up the learning curve.

Improve efficiency

When conversational AI becomes the initial contact point for interactions with customers, companies can see how processes for cooperating across silos work- and don't work - and can see how to increase efficiency. The virtual agent also provides a way for faster updating of customer-facing or agent-facing informationa cross all parts of the enterprise.

Here are some examples of common queries that conversational AI can handle:

Selecting coverage

The virtual agent can guide customers through the buying process by asking the right questions and presenting them with a customized selection of offers that meet their individual needs. If a policy is complicated, or a customer simply wants the assurance of a human voice, a human agent can pick up wherever the virtual agent leaves off - having saved considerable time and having begun the conversation on the right foot, based on the customer's preferred mode of interaction.

Filing a claim

Submitting a first notice of loss (FNOL) can be confusing - and emotions can be running high after a car accident or other scare such as a major storm. A virtual agent can guide policyholders through the filing in a conversational way, while also eliminating the need for many confusing, complex forms.

Understanding benefits

Conversational AI can handle the huge volume of routine questions about coverages, payment schedules and policy documents - and in a personalized way, not just by referring the customer to a section of a manual that probably answers the questions… somewhere… if you look hard enough.

Updating policies

Using the virtual agent, customers can easily make changes to their policies and coverages, such as by adding a vehicle, updating an address, or canceling a policy that is no longer needed.

Educating insurance agents

The virtual agent can be used to quickly update agents with new information on policies, benefits and procedures, including suggestions on converting new customers and supporting existing policyholders.

Supporting the contact center

The reps in the call center also benefit from a conversational AI tool, because it pulls together all of a company's data on a customer and puts it at the reps' fingertips. As a result, they avoid tedious searching and can focus on connecting with customers and delivering a positive experience every time.

Conclusion

Customers are demanding that insurers give them more ways to interact with them digitally, and conversational AI does that in the best way possible .Customers (and agents) can conduct business or ask questions of insurers at anytime of the day or night, in a convenient, natural way - while the virtual agent, always learning, helps companies operate more efficiently.

Conversational AI is one of those rare beasts in business: It delivers demonstrably better service to customers while cutting companies' costs. How often does that happen?